Getting a credit report can help protect your credit history from errors and help you spot signs of identity theft. Always check to be sure the information is accurate, complete, and up-to-date... and it is important to do this at least once a year, and it's free to do so.

Credit bureaus collect and maintain information about your credit history, which is used to create your credit report and score. Lenders and insurers use your credit report to assess your creditworthiness to determine whether to grant you a loan, credit card, car loan. Rental properties will often pull credit scores, so you want to make sure you know your number and your report is accurate.

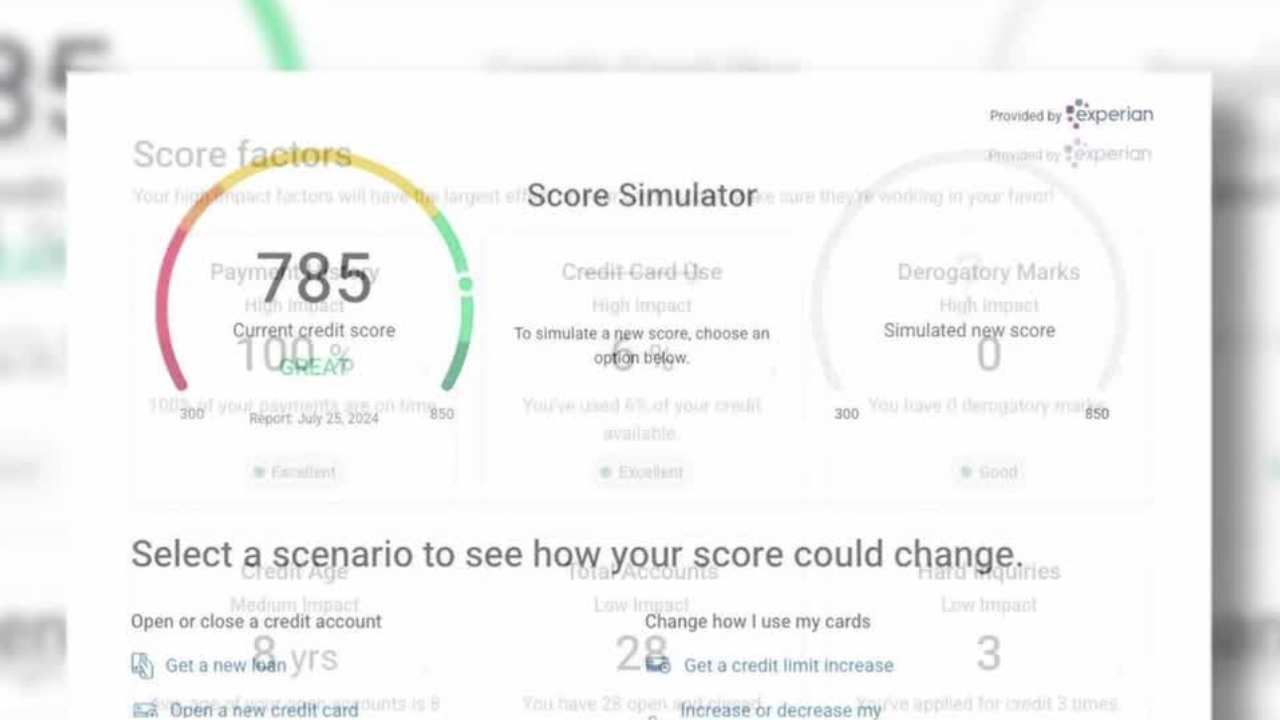

A good credit score generally falls between 670 and 739.

How to check if interest is working for or against you:

"There's 3 major credit bureaus that compile information; you don't consent for that information, they just collect it, and then they create that score so you can request a free credit report," explained Dave Nellis with America First Credit Union.

The three major credit bureau agencies are Experian, Equifax and TransUnion.