SALT LAKE CITY -- A revised bill that overhauls Utah's tax code could be released as soon as Friday.

Speaking to reporters, House Speaker Brad Wilson, R-Kaysville, said the next public hearing on the revised bill would be Monday afternoon.

"Overall, Utahns are going to be paying less tax to the state of Utah starting next year if we get this accomplished," he said.

Speaker Wilson said there were a few changes made as a result of public feedback, including some tweaks to which services now face a sales tax. That has been one of the most controversial aspects of the bill, with public comment largely against it.

Republican lawmakers on Capitol Hill have argued a tax overhaul is necessary as people pay for more services than they do goods, and revenues are declining. Those revenues pay for critical government services like roads, schools and health care.

The proposed bill has an income tax cut, but taxes new services, looks at a "user fee" for roads and raises the sales tax on food. Legislative leaders have argued there would be tax credits for those who need it. It also would remove the earmark for education on the income tax, something that would require voter approval. Education groups have lined up to oppose that.

"I would say we’re making progress to give them an option instead of the constitutional earmark," Speaker Wilson said of negotiations with education officials. "Something that’s actually more certain than what we have now."

After a similar tax overhaul bill imploded in the legislature earlier this year, lawmakers spent the summer traveling the state to discuss why it's necessary and take public feedback. Republican leadership in the House and Senate have said they could have a special session to pass a tax bill by December.

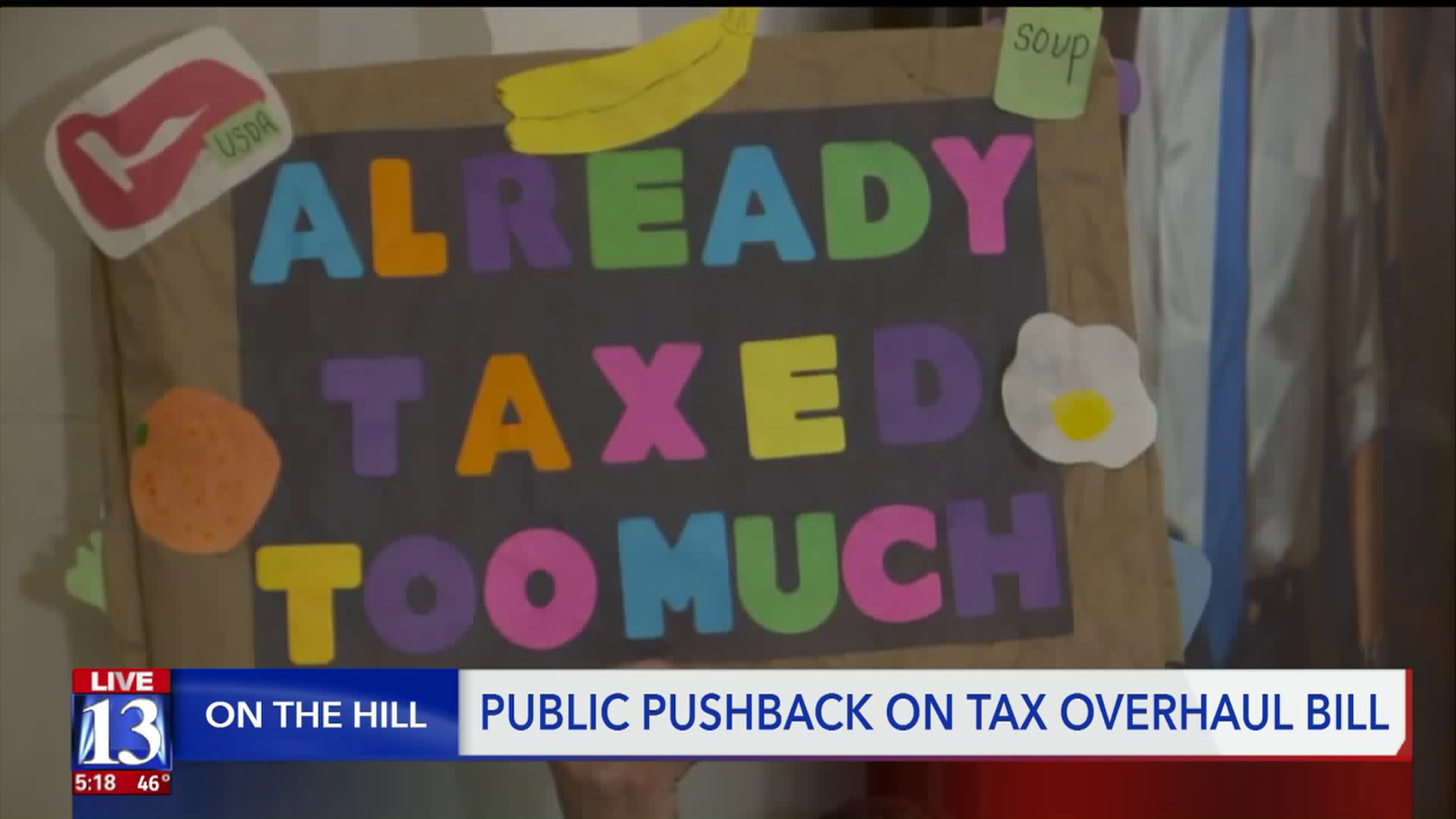

On Wednesday, religious groups and advocates for the poor blasted the sales tax hike on food. Utahns Against Hunger said lawmakers are determined to pass a bill over objections that it unfairly hurts those in need.

At a news conference on Capitol Hill, anti-poverty advocates and religious groups including the Catholic Diocese of Salt Lake City called on the food tax to be repealed.

"These families are struggling month to month, check to check, and will unfairly be impacted by the proposed changes to the tax structure," said Rev. Vinetta Golphin-Wilkerson of Granger Community Church. "We should not change the tax system so that those with less money are forced to pay more for groceries every month while their landlords and employers pay less total tax each year."

Rep. Sandra Hollins, D-Salt Lake City, joined the anti-poverty advocates at the news conference and called on Utahns to call their lawmakers to stop the tax bill.

"I think it’s stoppable by the voters. I think they’re going to have to be the ones to call their legislators and let them know we do not like this bill," she said.